Motor Vehicle Expenses - Employees

If you use your car for work you are entitled to claim the costs of using your car to do your job as a tax deduction.

You can claim motor vehicle expenses for travel between:

- Your workplace and an alternative workplace (eg. a clients property, place of training etc.)

- An alternative workplace and another alternative workplace (eg. one client’s property to another)

- Two separate work places (eg. when you have a second job)

- To and from work when you have to carry bulky tools and equipment you need to use for work

You cannot claim the cost of normal trips between home and work because that travel is private even if:

- You do minor tasks on the way to work, such as picking up the mail

- You work overtime and no public transport is available to use to get you home

- You are carrying equipment that is not bulky or could be stored at your workplace

There are a number of methods you can use to claim the car expenses.

Method 1 – Cents per kilometre

- Your claim is based on a set rate for each business kilometre you travel and you can claim a maximum of 5,000 kilometres under this method. If you travel more than 5,000 kilometres the claim must be limited to 5,000 or you need to use an alternative method of claim.

- You do not need written evidence but you need to be able to demonstrate that you have incurred the expense. Diary records will be sufficient.

Method 2 – 12% of original value

- Your claim is based on 12% of the original value of your car. The Luxury Car Limit of $57,466 will apply.

- Your car must have (or would have) travelled more than 5,000 business kilometres in the income year.

Method 3 – One-third of actual expenses

- You claim one-third of your car’s expenses.

- Your car must have (or would have) travelled more than 5,000 business kilometres in the income year.

- You need written evidence of fuel costs and for all other expenses for the car.

Method 4 – Logbook

- Your claim is based on the business use percentage of each car expense which is determined by a log book that must have been kept for a minimum 12 week period. This log book must be updated every 5 years.

- You need odometer readings for the start and end of the period that you owned or leased the car.

- You need to detail all the kilometres you have travelled for the log book period.

- You can claim all expenses that relate to the operation of the car and you will need to keep receipts to justify your claim.

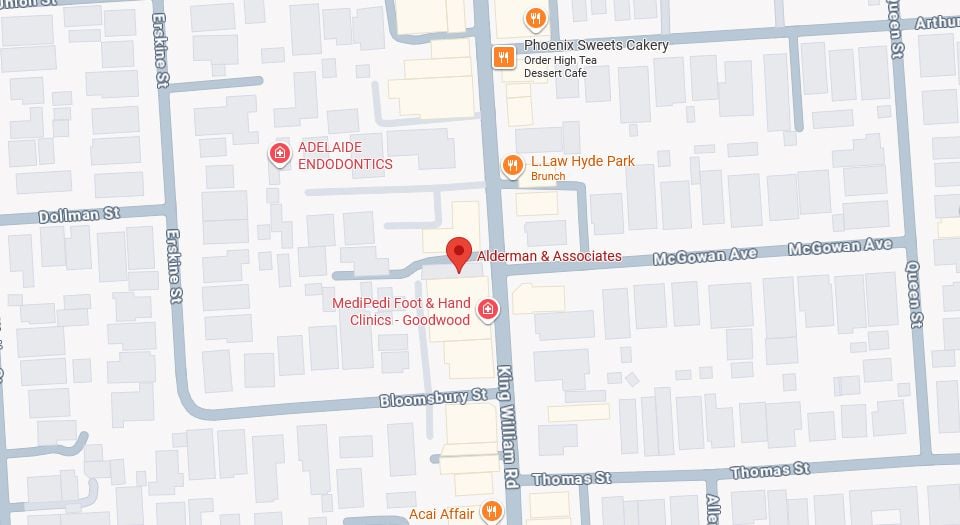

Contact our office for more information.

| Tags:ATOStrategyPlanning2013Tax ObligationsAdmin |

Post comment

&geometry(352x80))